Introduction

Why apply for a Certificate of Chinese Fiscal Resident (“Chinese Tax Residency Certificate”)? To claim tax benefits under the tax treaties entered by the Chinese Government and other countries or regions (including the taxation avoidance agreements signed between the Mainland of China and China’s Special Administrative Regions of Hong Kong and Macao, and the agreement between the Mainland of China and China’s Taiwan).

For instance, under Belgian tax law, interest paid by a Belgian company is, in principle, subject to 30% withholding tax. Pursuant to the tax treaty between China and Belgium, the withholding tax rate can be reduced to 10%. However, to be fully valid, the reduction must meet certain formalities including the filing reduction application form. The Chinese Tax Residency Certificate may be required.

In this article, I will briefly discuss how to apply for a Chinese Tax Residency Certificate so that applicant may benefit from the applicable tax treaties.

I.Applicant

A resident enterprise or a resident individual (“applicant”) may apply for a Chinese Tax Residency Certificate from a competent tax authority.

A resident enterprise refers to an enterprise that is established in China, or an enterprise that established outside China, but whose actual management office is in China.

An individual who has a domicile (meaning individual who habitually residing in China because of his or her permanent residence, family or economic interests) in China or an individual who does not have a domicile in China but has resided in China for 183 days or more cumulatively within a tax year (which begins on January 1 and ends on December 31 of a calendar year) shall be deemed a resident individual from Chinese tax law perspective.

This article focuses on discussing from the perspective of individual applicants who do not have a domicile in China but have resided in China for 183 days or more cumulatively within a tax year.

II.Authority

An individual applicant, who does not have a domicile in China but has resided in China for 183 days or more cumulatively within a tax year, shall apply to the tax authority at the county level which oversees the applicant's income tax (the "competent tax authority") for issuing a Chinese Tax Residency Certificate.

III.Materials

Application Form for Chinese Tax Residency Certificate (can be downloaded from the website of provincial level tax authorities or collected from the tax service halls) and supporting materials such as contracts, agreements, and payment vouchers, etc. which related to the proposed income for entitlement to tax treaty benefits will be needed.

For the applicant is an individual who does not have a domicile in China but has resided in China for no less than 183 days in a tax year, documents providing an individual’s physical presence in China, including the information on entrance and departure into or from China shall be submitted conditionally.

In practice, the applicant usually needs to provide a copy of his or her passport to demonstrate relevant information such as nationality, date of entrance or departure etc. Moreover, a declaration to certify the applicant lives at a physical address and works in China and holds a residence permit for foreigner of the People’s Republic of China by landlord and/or his or her employer may also be requested. We often see that the applicant submits the relevant Notarial Certificate of declaration although it is not mandatory by law.

If the competent tax authority cannot make a judgment based on the materials submitted by the applicant, the applicant may be required to provide additional relevant materials and at one time shall be informed of what materials are additionally required in writing. The time for the applicant to provide additional information will not be included in the timeframe for the processing.

IV.Format

The information filled in or provided by the applicant shall be submitted in Chinese, and if the original copy of the relevant material is in a foreign language, a Chinese translation shall be provided at the same time.

When the applicant submits a printed copy of the above materials to the competent tax authority, the applicant’s seal or signature shall be affixed on the copy, and the competent tax authority shall keep the printed copy after verifying the original copy.

The applicant may use e-signatures that meet the requirements of the Electronic Signature Law of the People’s Republic of China, which have the same legal effect as handwritten signatures or seals.

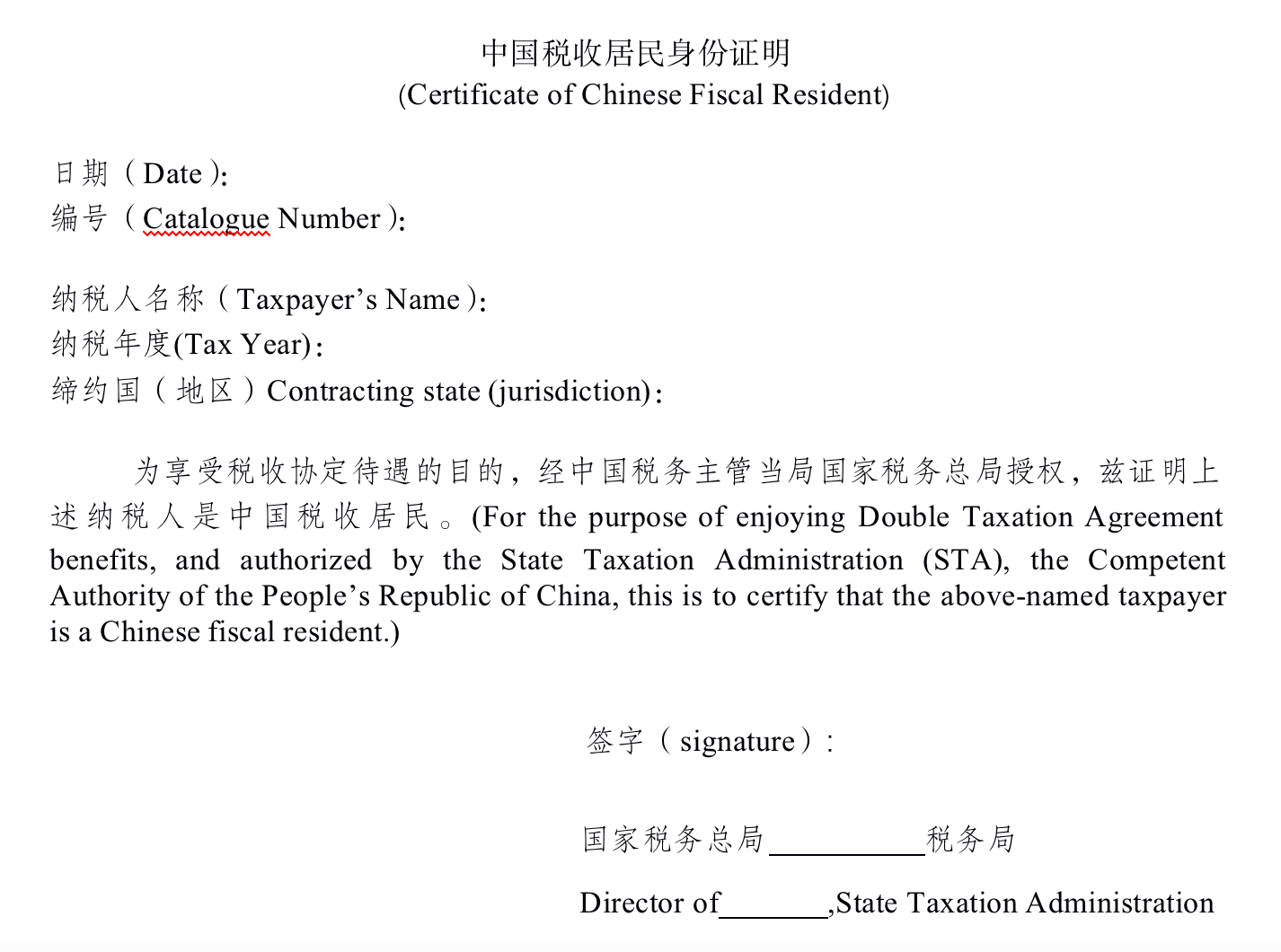

A standard form of a Certificate of Chinese Fiscal Resident shows below.

In addition, If the authority of the other contracting party of the tax treaty has special requirements for the format of the Chinese Tax Residency Certificate, the applicant can provide a written explanation of the special requirements and the required application format of the Chinese Tax Residency Certificate. The competent tax authority may issue the certificate according to the special requirements.

V. Procedure

An applicant may apply for a Chinese Tax Residency Certificate in any calendar year in which it qualifies as a Chinese tax resident.

The applicant needs to visit the tax authorities only once at most on the precondition that the materials are complete and meet the legal requirements for acceptance.

The applicant may use the online service e-tax bureau to submit the application and relevant materials. However, the e-tax bureau service access may not be available in some of tax authorities, especially for individual applicants.

The competent tax authority shall close the application within 10 working days from the date of acceptance; if the competent tax authority cannot determine the applicant’s resident status and needs to submit the application to the higher-level tax authority, the application shall be closed within 20 working days.

In practice, the progress may take less 10 days to issue the certificate. For instance, Shandong Provincial Tax Service, State Taxation Administration promised that 3 working days for standard applications, and 7 working days for complex applications that need to be reviewed by a higher level of tax authority.

After processing the applicant’s application within limited period, the competent tax authority shall issue the Chinese Tax Residency Certificate with the official seal of the bureau and signature of its Director or shall notify the applicant in writing of the reason for non-issuance of the Chinese Tax Residency Certificate.

VI.Fees

Free of charge.

Key takeaways

• Non-domiciled individuals who have resided in China for 183 days or more cumulatively within a tax year shall be deemed as resident individuals, therefore he or she may be eligible to apply for a Chinese Tax Residency Certificate. However, the Taxpayer’s Identification Number in China may be requested.

• The key issue for non-domiciled individuals would be conducting a self-assessment to calculate the number of days the individual stay in China cumulatively within a tax year and provide supporting documents accordingly. Where an individual stays in China for less than 24 hours a day, the day shall be excluded from his or her stay period in China.

• Chinese translations shall be provided where the original of the relevant materials are in a foreign language.

• In general, the notarization is not mandatory for submitting the supporting documents unless the competent tax authority requires it.

• The competent tax authority may issue the certificate according to the special requirements if the authority of the other contracting party of the tax treaty has special requirements for the format of the Chinese Tax Resident Certificate.

• Additional materials may be requested if the competent tax authority cannot make a judgment based on materials submitted by the applicant.

Please note that this article is not intended and cannot be constituted as a comprehensive analysis of the related Chinese law or under any circumstances as legal advice from the author and Tsinglaw Partners.

2024-07-11

2024-07-11.png)

上一篇

上一篇

.png)